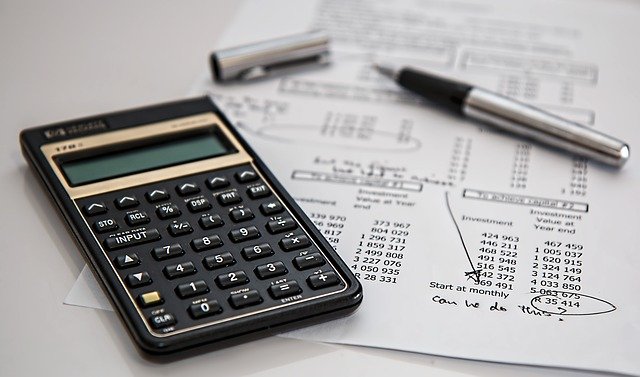

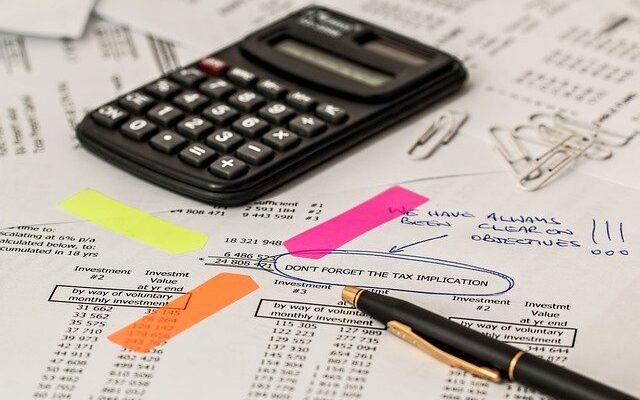

How to Reconcile your Bank Statement? Step by Step Guide

Reconciling your bank statement serves several purposes. First, it helps you verify all of your bank transactions, ensuring there are no mistakes. It’s also a time to make sure you didn’t miss a payment or pay someone twice. And you can track any uncashed checks or bounced payments from the previous month.

Reconciling your statement also gives you an insight into your finances and how you spend your money. This can lead to better money management, especially at a time of when the crisis has hit personal finances and expenses.

Here are some quick and brief tips to follow when you are reconciling your bank statement:

- Check your bank statement against other records: This can be a written log and receipts, budgeting software or an app.

- Check the balance: Make sure the starting balance on your bank statement matches your records. If not, find out why and correct the issue.

- Check deposits: Review the deposits listed on your bank statement to ensure they match up to your records

- Check withdrawals: Check your withdrawals in the same manner you checked deposits.

- Reconcile your accounts: If something doesn’t add up, work to fix the issue by adjusting your own records or by working to correct bank errors. The goal is for the ending balance on your statement to match your records each month.

Covid-19 UAE: 10-Day Quarantine Mandatory in Dubai for Close Contacts

Export Shipping Documents Checklist to complete your First Trade