Edenred UAE launches new C3Pay mobile app

Press Release

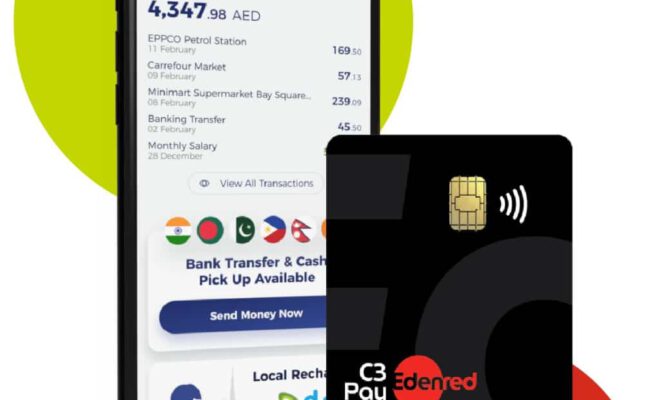

Dubai, United Arab Emirates – Payroll solutions provider Edenred today announced the launch of its revamped mobile banking application, C3Pay, with the aim to offer its cardholders a seamless and streamlined digital banking experience. The new features enhance security in order for its users to take full control of their financial health during this unprecedented time.

According to a statement from the Federal Bureau of Investigation, the use of mobile banking has increased by 50% so far this year, and we are continuing to seeing an increase as the pandemic expands. Another survey by Ondo cited an increase in contactless payments with 30% of consumers trialling this feature for the first time since the pandemic. Moreover, 70% of these same consumers shared their preference to continue to use contactless solutions even after the pandemic.

Anouar Bourakkadi Idrissi, CEO of Edenred UAE commented, ” We have seen a sharp uptake in mobile banking in the first half of the year, partly due to the disruption caused by COVID-19. At Edenred UAE, we believe digital banking is key to empower employees by providing them with seamless access to their finances. We offer our cardholders a safe and secure platform to conduct their online transactions and protect our users by promptly communicating safety guidelines in-app, by email and through SMS. We made significant improvements based on direct feedback received from our customers, addressing their priorities, challenges, and limitations”.

The penetration of smartphone has grown from 73.8% in 2016 to 96% in 2019 (even in the unbanked segment). During the stay-at-home public health emergency, millions of customers flocked to digital banking to transact from the comfort of their homes and C3Pay app offered a smooth digital payment experience to its cardholders to remit money home or for mobile recharge. Since the outbreak of COVID-19, it is becoming critical for the UAE businesses to ensure financial inclusion and digital onboarding for both the banked and unbanked population, ironically more than 60% of the UAE’s current working population, especially in manufacturing, trading, F&B and construction, sits outside the traditional banking system.

“To add to the current challenges, an increase in the number of fraud cases has been observed during COVID-19. To help our users with this new challenge, we promptly introduced the ability to block cards instantly from the C3Pay app in the case of any unauthorized transactions or suspicion. Furthermore, the C3Pay mobile app enables users to recharge their phones, and complete money transfers without visiting a crowded area, to protect their best interest of their own safety and well-being. We’ve also addressed the need for customer services by launching a Whatsapp support channel, offering cardholders assurance that they have someone to reach out to should they require personal assistance in transferring money home” said Bourakkadi Idrissi.

Edenred’s latest C3Pay mobile app is available for download on Google Play and App Store for all the current C3Pay cardholders. It features a clean look, robust mobile banking services, improvements to SMS alerts and notifications, the ability to report lost or stolen card, replacement of the current card and instant money transfers to other C3Pay accounts. These timely features can make it easier and more secure for cardholders to bank, providing them with detailed information to make smart choices in managing finances.

The new features of the mobile app include:

- A convenient looking dashboard with the option of transfer money, instant mobile recharge, SMS security alerts, updates on COVID-19

- A detailed transaction history

- An easy option to block/unblock the card or to request the replacement of the card

- Instant money transfers between C3Pay cardholders

- Whatsapp support channel for money transfers queries

- Updated exchange rates for international money transfers powered by RAKBANK

“The modern interface, feedback-oriented feature extensions and deploying the best in class security measures are just the beginning of our roadmap towards our customer’s financial goals and our priorities are aligned to deliver the best user experience to them. Innovation in consumer technology and the rise of fintech are not only driving the growth of electronic payments but changing the face of the financial services sector resulting in greater financial inclusion, which means a lot to us at Edenred. Delivering a seamless banking experience around the clock and enabling it at any convenient location for the end user is the goal for financial-technology applications,” added Bourakkadi Idrissi.

Edenred offers an innovative and smooth payroll solution – C3Pay, which enables companies to conveniently process salaries of employees through a secure corporate portal in compliance with WPS and in turn empower employees by providing them with a Mastercard linked to C3Pay mobile app. The mobile app enables both unbanked and underbanked people to control their finances and manage their money better by giving them access to essential digital features. In addition, the company also has a dedicated WhatsApp support number +971588762762 to assist customers with money transfer related query.

Edenred currently serves more than 6,000 companies, over 10 banks, 35 financial institutions, and over two million cardholders.

To learn more about Edenred’s offerings, visit https://edenred.ae/

Covid-19 UAE: 10-Day Quarantine Mandatory in Dubai for Close Contacts

Export Shipping Documents Checklist to complete your First Trade